Regulation A+ Crowdfunding

Regulation A+ Crowdfunding is a type of financing in which funds are collected by asking a large number of people to make relatively modest individual investments or contributions. Crowdfunding in general has been a well-liked method of raising money for a variety of artistic, charitable, or social purposes. Crowdfunding platforms like Indiegogo or Kickstarter that rely on donations or rewards don’t pay out any money. Now, with recent changes to federal law, businesses may use the power of crowdfunding to do what is called Regulation A+ Crowdfunding to fund their ventures.

Crowdfunding appears to be democratizing access to capital among a larger pool of innovators who are coming up with innovative ideas around the U.S. We’re seeing that this trend is very strongly positive and has been increasing over time.

Wharton management professor Valentina Assenova

A business must abide by federal securities laws if it wants to promote and sell securities through crowdfunding. Any offer or trade of security is subject to federal securities laws and must either be registered with the SEC or qualify for an exemption.

Regulation A+ Crowdfunding: “Regulation Crowdfunding”

Regulation Companies can offer and sell up to $1.07 million of their securities through crowdsourcing without having to register the offering with the SEC, as it offers an exemption from the registration requirements for securities-based crowdfunding.

The general public now has the chance to take part in start-up and early-stage companies’ early capital raising activities thanks to regulation crowdfunding. A Regulation A+ Crowdfunding campaign is open to everyone. However, you are restricted in how much you can invest in these transactions over any 12 months due to the risks associated with this form of investing. Your annual income and net worth will determine the maximum amount you are permitted to spend.

All equity-based crowdfunding platforms, which collect money for smaller and bigger businesses, are made to give investors a profit. While regulated crowdfunding is an equity-based tool that offers financial returns to investors, it differs from unregulated crowdfunding in that it is subject to SEC regulation in the United States.

In 2015, the SEC passed Regulation Crowdfunding laws, allowing people to engage in securities-based transactions within certain investment parameters. The amount of money an issuer can collect is restricted, and they must adhere to certain disclosure guidelines regarding their operations and securities offering. Broker-dealers and funding portals that participate in crowdfunding deals are also subject to Regulation Crowdfunding, which controls their actions.

The need to ensure that the interests of small businesses seeking capital are appropriately balanced against investment protection and the needs of investors to obtain information essential for their investment decisions has arisen as a result of the rapid growth in low-documentation, start-up phase financing of small projects and businesses.

Eligible companies can offer and trade securities through crowdfunding thanks to regulated crowdfunding. All regulated crowdfunding deals in the US must be conducted online through a broker-dealer or funding portal that has registered with the SEC as an intermediary.

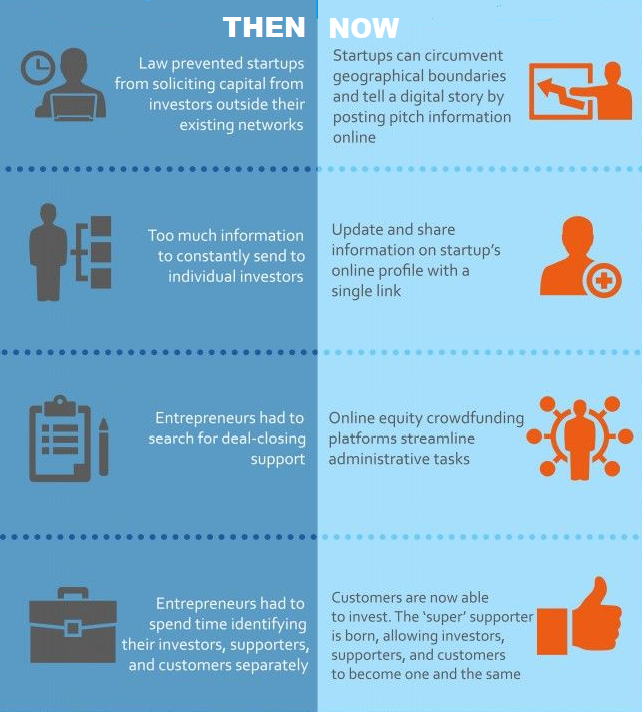

For decades, only Wall Street and the uber-wealthy were able to invest in companies for an equity stake; so Main Street figured out a way around this. Crowdfunding connects startups and nonprofits that need funds for their ideas with individuals who have money and believe in them. But crowdsourcing means much more than raising funds from the public. If done right, it can be very rewarding.

Bloomberg Businessweek

A prospective investor must create an account with a broker-dealer or funding portal that is a crowdfunding intermediary to invest. Any written correspondence regarding that donation made through a crowdsourcing site must be sent electronically. The US Securities and Exchange Commission (SEC) controls who can participate as investors and issuers, how portal operators should handle their business, and how they should comply with reporting requirements.

A business is only permitted to raise a certain amount overall within 12 months. A single investor’s total monetary investment across all crowdfunding offerings within 12 months is restricted by the SEC. In general, securities bought through a crowdfunding deal cannot be sold again for a year. Regulations governing crowdfunding deals include “bad actor” disqualification clauses. If the issuer or other “covered persons” have experienced a disqualifying event, such as being found guilty of, or subject to court or administrative penalties for securities fraud, or have broken other specified laws, the provision disqualifies the offering.

Regulation A+ Crowdfunding: The JOBS Act

The Jumpstart Our Business Startups (JOBS) Act, which was passed on April 5, 2012, established the stock crowdfunding sector in the US. Only approved investors were initially permitted to make investments. Section IV (Regulation A+ Crowdfunding), another provision of the JOBS Act, took effect in June 2015. Larger businesses were permitted by Title IV to raise money from regular individuals who were not accredited investors. Section III (Regulation Crowdfunding) of the JOBS Act took effect nearly a year later, in May 2016. By enabling early-stage startups to request offerings up to $1 million within 12 months from either accredited investors or regular people, it expanded the reach of the U.S. stock crowdfunding platform. For new and existing small businesses in the US, Title III, or Regulation Crowdfunding, generated 300 million potential new investors.

For many modern entrepreneurs, equity crowdfunding is a godsend. It allows them to quickly and conveniently accumulate the capital they need to get started without having to hunt for the perfect individual investor or take on debt.

Entrepreneur Magazine

Regulation A+ Crowdfunding Under the SEC & JOBS Act

The SEC has adopted several regulations to help facilitate the growth of EGCs, as mandated by the JOBS Act.

Regulation A+ Crowdfunding

The SEC also amended Regulation A to permit smaller businesses to offer and trade up to $50 million in securities over a year without needing to adhere to all regulations governing registered securities. Different disclosure and reporting rules apply to two tiers of offerings (up to $20 million and up to $50 million).

Issuers are now able to conduct intrastate offers and purchases of securities without first registering them with the federal government thanks to changes to Rule 147.

Regulations from individual states frequently demand that services over a certain threshold be registered. The SEC also passed a rule allowing issuers to promote offerings to state residents via email (even if the advertisement is seen by residents of other states), provided that the sale is limited to those who live in the state.

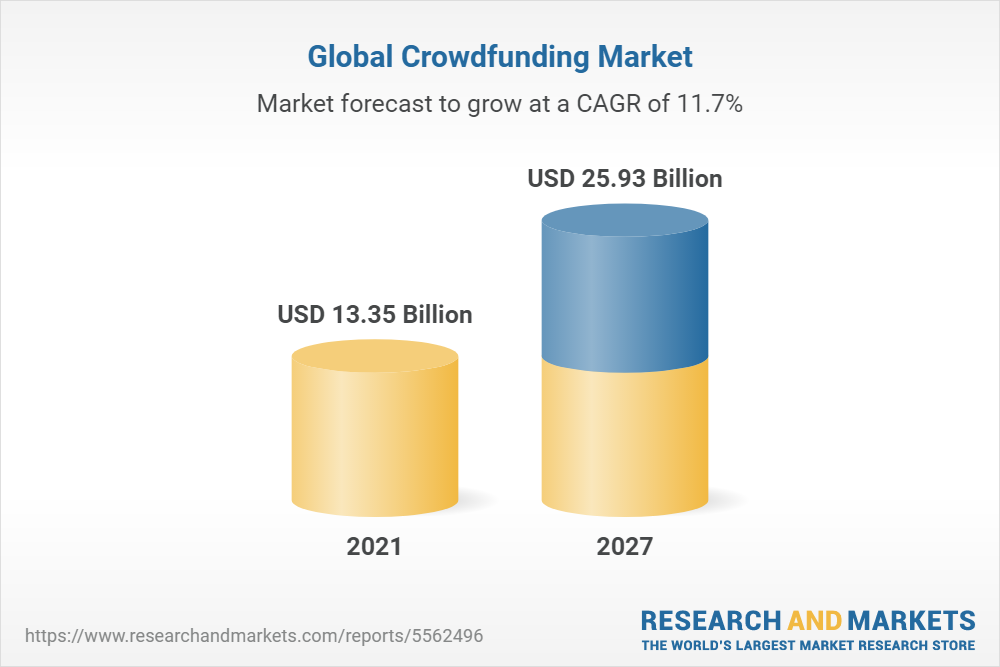

Equity crowdfunding outperforms traditional markets in 2022 with $30 billion a year growth forecast by 2028

Guide to Regulation A+ Crowdfunding FAQ:

Because of technology, the internet, and social media, there is now a regulated crowdfunding environment. Because the SEC, the US government, and JOBS Act backers pushed for regulated crowdfunding, it is now available to investors and prospective start-ups, and it is spreading around the world.

The US Jumpstart Our Business Startups Act (JOBS Act), which exempts so-called emerging growth companies (EGCs) from many of the requirements for listed companies, including governance structures, disclosure requirements, and shareholder-rights provisions, aims to increase the flow of investor capital to these companies. These exemptions aim to make the environment more hospitable for EGCs by lowering regulation costs and disclosure requirements and allowing owners and insiders more freedom to alter governance structures.

The JOBS Act’s Section IV also referred to as Regulation A+ Crowdfunding or Reg A+, is a development of the law. After much anticipation and a protracted wait, it finally debuted in May 2015. Reg A+ is the name of an exemption that enables small businesses to offer their shares to the public, enabling virtually anyone to participate in a company through crowdfunding. It makes it possible for crowdfunding platforms and startups to collect capital from accredited and unaccredited investors so that the general public can invest in private businesses.

Additionally, it permits businesses looking for equity funding to openly promote their offerings. It has contributed to the development of a successful method for businesses to provide investor security while raising capital.

The audience is the main distinction between Regulation A+ Crowdfunding and other exemptions that were previously accessible to security makers. Most of the prior exemptions only permitted businesses to take investments from accredited investors, whereas Regulation A+ permits participation by all investors and functions as a mini-IPO.

Tiers I and II of Regulation A+ Crowdfundings are separated.

Here is a summary of how they vary from one another:

With Tier I, qualified businesses with headquarters in the United States and Canada may offer and sell up to $20 million in equity.

Five million dollars was the prior cap. The business must pass a coordinated evaluation by the state, and ongoing compliance is required for its financials. The amount that can be invested in the business is unrestricted.

With Tier II, qualified businesses with headquarters in the United States and Canada may offer and sell up to $50 million in equity.

The amount that non-accredited investors may spend is capped. Depending on which is higher, they may invest up to 10% of their annual income or net wealth each year. Additionally, Tier II offerings must continue to comply with yearly reporting and audited financial reporting standards.

The pre-emption of Blue Sky Laws for Tier II may be one of Regulation A+ Crowdfunding’s greatest changes. Simply put, this eliminates the need to register the offering in every state where a business offers its securities to eligible buyers. Tier II of Regulation A+ Crowdfunding is usually the preferred tier for start-ups and small businesses due to the preemption of state law.

Crowdfunding is a method for collecting money that has advantages and disadvantages, just like any new regulatory change.

Crowdfunding has several benefits for businesses looking to raise capital, including the fact that it is less expensive and complex than an initial public offering (IPO) and necessitates fewer disclosures and regulations. Another potential benefit is that there are fewer restrictions on the amount of money that an individual investor can invest, and the amount of money that a business can raise has increased significantly.

However, for young businesses looking to expand rapidly while incurring minimal start-up costs, crowdfunding can be a time-consuming and costly process. Even though the procedure is not as difficult as an IPO, it still needs to be approved, which can cost a lot in filing, insurance, and legal costs.

More info on the JOBS Act from the SEC official website

So, Why Regulation A+ Crowdfunding Specifically?

Under Title IV of the JOBS Act, which preempts state law, the SEC published the final Regulation A+ crowdfunding rules, paving the way for $50 million in unaccredited investor equity crowdfunding. As a potential substitute for venture capital or other institutional capital, growth businesses will soon be able to raise $50 million from unaccredited investors in a mini-IPO-style offering. Imagine Uber or AirBnB selling their stock directly to their drivers, riders, renters, and tenants in addition to the general public, rather than turning to large organizations for funding.

Many people thought that Title IV of the JOBS Act would make the biggest change when it was passed in April 2012, but because there was no deadline for putting the rules into effect, most people ignored it as being too far off to give it any real consideration. Concerns were also raised about the same issue that plagues the current Regulation A, namely state securities laws that would necessitate registration in each state where securities are traded, making it too expensive/complicated to be practical. The most notorious instance of this occurred in 1980 when Massachusetts forbade its citizens from taking part in the offering of Apple Computer stock because it was considered to be “too risky.”

However, the SEC shocked the securities industry last November when it unveiled Proposed Regulation A+ Crowdfunding regulations that, thanks to a deft legal ploy, pre-empted state securities regulation.

Since that shocking declaration, there has been a lot of debate about “pre-emption,” including whether it is acceptable for a federal body to pre-empt the states in this way and whether it is legal. Pre-emption is fervently supported by the majority of pro-business people, who contend that securities offerings comprise interstate commerce and that state-by-state regulation is outmoded in a time when state lines are increasingly blurred by the internet. In opposition to such pre-emption, many regulators, investor protection organizations, and even one crowdfunding platform argued that state review provides value and essential investor protections.

To address these issues, the states responded by introducing a coordinated review procedure. Critics claimed that this action was too little, too late and that the states were only compelled to take it because of the danger of pre-emption.

Pre-emption for Tier II Regulation A offerings up to $50 million was confirmed in the final rule release by the SEC, who also increased Tier I Regulation A offerings from $5 million to $20 million while maintaining pre-emption, thus allowing “coordinated review” a chance to succeed. The outcome of lengthy negotiations between Commissioner Stein, who rejects pre-emption, and a number of the other Commissioners, appears to be this. The SEC mentioned the following when making its decision:

Preemption is required at least until there is a track record of a successful coordinated review program because the coordinated review is new and untested.

If the states can cooperate and keep the process streamlined, the coordinated review has a lot of promise.

A person may be appointed by NASAA to work closely with the SEC on Regulation A+ Crowdfunding implementation.

States will always have complete enforcement and anti-fraud authority.

Currently, it appears that pre-emption under Tier II and combined review under Tier I could make Title IV (Regulation A+ Crowdfunding) obsolete for Title III Equity Crowdfunding.

60 days following its publishing in the Federal Register, Regulation A+ Crowdfunding is anticipated to take effect (June 2015). The following list summarizes the new Regulation A+ exemption:

Highest Maximum Raise: Issuers may raise to $20,000,000 for Tier 1 and $50,000,000 for Tier 2 in a 12-month timeframe.

Everybody can invest in Regulation A+ Equity Crowdfunding:

Your friends and family can contribute as well; they are not restricted to “accredited investors.” The restrictions on investment for Tier 2 investors are, however, outlined below.

Individual investors may contribute up to 10% of their net worth or 10% of their net income in a Reg A+ offering for Tier II, whichever is higher (per offering). Under Tier 1, there are no financial restrictions.

Self-Certification of Income/Net Worth: Unlike Rule 506(c) under Title II of the JOBS Act, investors will be able to self-certify their income or net worth for the investment restrictions, eliminating the need for onerous paperwork to support income or net worth.

You can easily promote and discuss your offering, including at demo days, on television, and through social media, as there are no restrictions on general solicitation.

Offering Memorandum Needs Approval:

The issuer must submit verified financials and a disclosure document to the SEC.

Before any transactions, the document must receive SEC approval.

According to the regulations, the Offering Circular may be subject to the same degree of examination as a Form S-1 in an IPO.

The biggest possible disadvantage of using Regulation A+ Crowdfunding is this.

Audited Financials Needed: For Tier 2, the issuer must submit two years’ worth of audited financial records along with the offering circular. Only approved financials are necessary for Tier 1 offerings (not audited).

Testing the Waters: Before investing the time and money to produce the offering circular, an issuer can “test the waters” and determine whether there is interest in the offering. On SeedInvest, this is the “Preview” mode where investors can show interest but cannot yet invest. This is crucial so that businesses can gauge interest before spending money on legal and accounting costs and avoid having to gamble on their fundraising.

Ongoing Disclosure Requirements: For Tier 2, the issuer must submit yearly disclosure filings, semi-annual reports, and current reports, which are each abridged versions of Forms 10-K, 10-Q, and 8-K, respectively. Also necessary for these reports are continuing audited financials. If the number of shareholders falls below 300, these reports may be discontinued after the first year. For Tier 1, there are no ongoing disclosure obligations.

State Pre-Emption: As was previously mentioned, the old Regulation A (now Tier I) was never utilized because it required registering the securities in each state where an offer or transaction was made. Significantly, the New Reg A+ Tier 2 preempts state legislation once more. Again, Tier 1 Reg A+ does not preempt state law and will serve as a pilot project for NASAA Coordinated Evaluation.

Shareholder Limits: It appears that, in some instances, the Section 12(g) shareholder limits (2,000 persons and 500 non-accredited investors) will not apply to Reg A, which is a welcome departure from the proposed regulations. This resolves a significant issue with the planned regulations, which would have restricted the possibility of making very small investments (i.e., $100).

Securities with No Restrictions: Securities issued under Regulation A+ Crowdfunding will have no restrictions and will be freely transferable, but many issuers may decide to apply contractual transfer limits. Many people think that this will open the door for venture exchanges to serve as a secondary market for these assets.

No Funds: Reg A may not be used by investment firms (such as private equity funds, venture funds, and hedge funds) to raise money.

Integration: It appears that you can use Regulation A+ Crowdfunding in conjunction with other services because there are several safe ports.

The following are protected areas:

No integration with any previously closed offerings

No integration with a subsequent crowdfunding offering

No integration where the issuer complies with terms of both offerings independently – can conduct simultaneous Reg D – 506(c) offering.